| Straits Times Index |

Hang Seng Index |

Nikkei 225 Index |

| Click here to login to the chat room during market hours. | ||

|

| ||

| Follow @NeatTrade | ||

Thursday, November 26, 2009

Wednesday, November 25, 2009

Noble Group 15/11/2009

Noble broke out of the inverted H&S today. Estimated TP could be 3.28. We might see a throwback towards the neckline soon.

Labels:

channel,

inverted head and shoulder,

Noble Group,

patterns,

Singapore,

sti

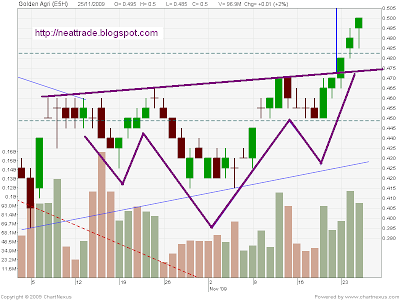

Kepcorp 25/11/2009

Labels:

kepcorp,

patterns,

Singapore,

sti,

stocks,

straits times,

symmetrical triangle

Monday, November 16, 2009

STI 16/11/2009 - update

Previous post for STI is here.

As per the previous post STI did make a partial decline to 2704 though not as low as I thought it would. Today it broke out of the resistance.

Take a closer look at the STI daily chart. We have an inverse H&S breakout. Estimated TP gives 2869!

As per the previous post STI did make a partial decline to 2704 though not as low as I thought it would. Today it broke out of the resistance.

Take a closer look at the STI daily chart. We have an inverse H&S breakout. Estimated TP gives 2869!

Labels:

inverted head and shoulder,

patterns,

Singapore,

sti,

straits times

UtdEnvirotech 16/11/2009

Nice little falling wedge. Trying to breakout with increasing volume. A close above 33 should see more upside. Just possibilities in the chart.

Labels:

falling wedge,

patterns,

Singapore,

sti,

stocks,

UtdEnvirotech

Friday, November 13, 2009

NOL 12/11/2009

H&S spotted on NOL. Current pullback is considered as throwback to neckline. It might head down. However, the breakout volume is not very convincing. Nevertheless it is a valid pattern. Only time will tell if it falls through.

Labels:

head and shoulders,

NOL,

patterns,

Singapore,

sti,

stocks,

straits times

Starhub - 13/11/2009

Starhub approaching multiple resistance. It has turned bearish a while ago. We might see some downside from here in the short term.

Depicted in the chart is just a possibility.

Depicted in the chart is just a possibility.

Labels:

broadening formation,

patterns,

Singapore,

Starhub,

sti,

stocks,

straits times

Thursday, November 12, 2009

STI 12/11/2009 - update

Previous post is here.

Nice rally since the previous post. We are approaching double resistance. Might pullback from there. If STI makes a partial decline creating a higher low, we may have more upside to come in the near future.

Nice rally since the previous post. We are approaching double resistance. Might pullback from there. If STI makes a partial decline creating a higher low, we may have more upside to come in the near future.

Labels:

patterns,

Singapore,

sti,

stocks,

straits times

Wednesday, November 4, 2009

Monday, November 2, 2009

KepCorp 02/11/2009

Labels:

kepcorp,

patterns,

Singapore,

sti,

stocks,

straits times,

symmetrical triangle

Subscribe to:

Posts (Atom)